IRA Charitable Rollovers

In December 2015, Congress permanently reinstated the IRA Charitable Rollover. This giving mechanism is an easy and practical way for qualifying donors to support La Jolla Symphony & Chorus. The IRA Charitable Rollover allows individuals age 70-1/2 or older to:

- Make a “qualified charitable distribution” directly from their IRA account to a qualifying

charity (such as the La Jolla Symphony & Chorus) in an amount of up to $100,000; - Exclude the qualified charitable distribution from their taxable income.

These rules apply only to qualified charitable distributions that would otherwise have been included in a donor’s gross income for federal income tax purposes. An eligible donor can also make an IRA Charitable Rollover even if not required to take a minimum distribution from his or her IRA.

How to Make a Tax-Free Gift From Your IRA

To benefit from the tax advantages of an IRA Charitable Rollover, your payment to La Jolla Symphony & Chorus (LJS&C) must come directly from your IRA administrator. Checks should be made payable to: La Jolla Symphony & Chorus Association and mailed to us at: 9500 Gilman Drive, UCSD 0361, La Jolla, CA 92093-0361

We ask that, separately, you send a letter to LJS&C informing us of your gift intent. Acknowledgement of your gift will be mailed after receipt from your administrator. To discuss a charitable gift from your IRA, please contact LJS&C Executive Director Stephanie Weaver Yankee at (858) 822-3774 or by email at sweaver@ljsc.org

Because the treatment of an IRA Charitable Rollover or other charitable gift depends on your individual circumstances, it is always wise to consult your tax advisor.

La Jolla Symphony and Chorus Association is a 501(c)3 nonprofit charitable organization.

Federal Tax I.D. No. 95-1962652

By giving to the La Jolla Symphony & Chorus’s (LJS&C) Annual Fund you ensure our artistic and financial success this season. The Annual Fund includes all contributions from private sources that can be applied to general operating expenses in a given year. Donors to the Annual Fund receive recognition in the LJS&C program guide and many other benefits.

The La Jolla Symphony & Chorus is a 501(c)3 non-profit corporation, Federal Tax ID: 95-1962652. Donations are tax-deductible!

Enjoy the benefits of your Annual Fund contributions year round!

Your contribution to the La Jolla Symphony & Chorus makes you a valued member of our organization and partner in our success.

Friend ($100-$249)

- Your name listed in all of the season’s concert programs

Member ($250-$499)

- All of the above

- LJS&C concert CD*

Patron ($500-$999)

- All of the above

- Invitation to annual donor appreciation reception

Associate ($1,000-$1,499)

- All of the above

- Valet at LJS&C concerts

Supporter ($1,500-$2,499)

- All of the above

- Fees waived on single-ticket purchases

Sustainer ($2,500-$4,999)

- All of the above

- 4 complimentary tickets to a subscription concert of your choice**

Benefactor ($5,000-$9,999)

- All of the above

- Complimentary string trio or quartet at your event

Angel ($10,000+)

- All of the above

- Dinner with the Maestro

*Pick up Member-level CDs on concert weekends at lobby table

**Sustainer-level complimentary tickets are based on availability

Therese Hurst Society for Planned Giving

Our Planned Giving Society is named in memory of our chief benefactress, who left her house to La Jolla Symphony & Chorus (LJS&C) in the 1980s, generating income that has afforded us a measure of financial stability. Members of the Therese Hurst Society are supporters who, through their generosity and financial planning, help ensure a brilliant future for the La Jolla Symphony & Chorus.

The Therese Hurst Society for Planned Giving recognizes La Jolla Symphony & Chorus supporters who have made a deferred gift through one or more of the following methods:

- Provision in their will or trust

- Retirement plan beneficiary designation

- Life insurance policy beneficiary designation

- Life estate gift (remainder interest in real property)

- Life income gift (charitable gift annuity, pooled income fund, charitable remainder trust or charitable lead trust)

Please Get in Touch

There are many ways to enroll as a member of our Therese Hurst Society for Planned Giving. Some of our donors may have already left the LJS&C a gift but are not being acknowledged because we have not been notified of their intent. Please contact us to discuss an existing or considered gift.

Contact:

Stephanie Weaver Yankee at (858) 822-3774 or by email at sweaver@ljsc.org

Please consult an attorney for legal advice on donating.

La Jolla Symphony and Chorus Association is a 501(c)3 non-profit charitable corporation.

Federal Tax I.D. No. 95-1962652

Corporate Sponsorship

La Jolla Symphony & Chorus offers a variety of opportunities for corporate and institutional partnerships. Let us help you communicate your message to our diverse audience. Partnerships can include:

- Branding at concerts and events

- Ticket packages for employees or customer promotions

- Hospitality events at concerts

- Year-round recognition

To learn more about how a customized partnership program can work for you, please contact at marketing@ljsc.org or 858-822-2166.

We are pleased to recognize the generous support of the following business and institutional partners.

$10,000 and Above

$5,000 to $9,999

$2,500 to $4,999

Community Partners

Giving a gift of appreciated stock or securities is a way to support the La Jolla Symphony & Chorus that may provide significant tax benefits to you. These benefits may include a charitable income tax deduction of the fair market value of the donated stock and elimination of capital gains tax on stock that has appreciated.

Please consult with your financial or tax advisor to help determine whether this giving option is best for you.

INSTRUCTIONS FOR STOCK TRANSFER

For contributors wishing to donate shares of publicly traded stock directly to the La Jolla Symphony & Chorus, please follow these instructions:

- Contact Stephanie Weaver Yankee, LJS&C executive director, about the intended transfer (sweaver@ljsc.org or 858-822-3774) so that she can alert the LJS&C fund manager of the impending transfer.

- Provide the following information about the LJS&C account with Schwab to your custodian.

Account Name: La Jolla Symphony & Chorus

Federal Tax ID: 95-1962652

Charles Schwab Account #5333-4139

DTC Clearing 0164, Code 40

Once the transfer is received, the fund manager will notify the LJS&C and the LJS&C will then send a tax letter to the contributor acknowledging the gift. The value is determined by the average of the high and low stock price on the day LJS&C received the transfer.

For additional questions, please contact Stephanie Weaver Yankee at sweaver@ljsc.org or 858-822-3774.

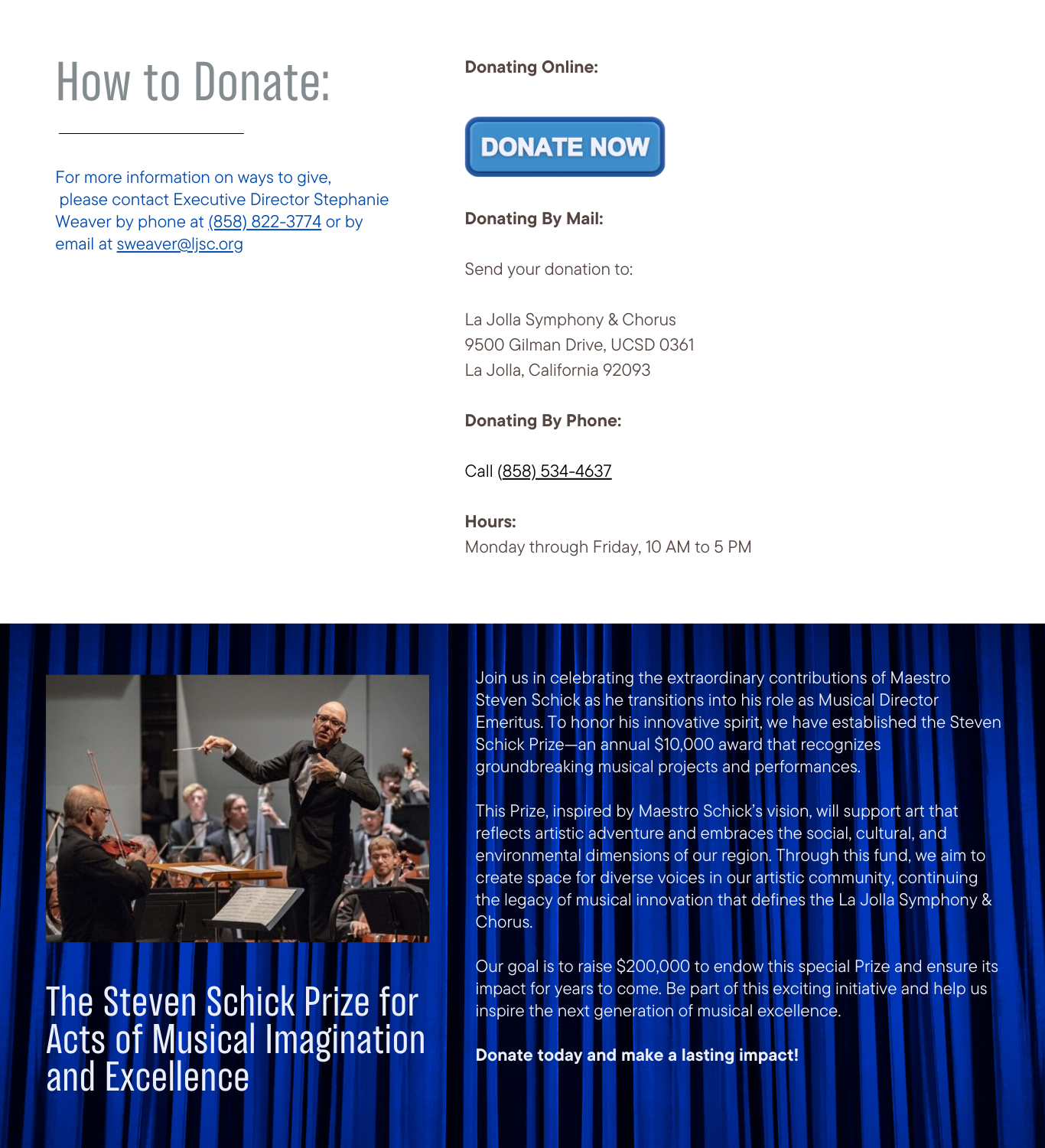

SUSTAINING OUR MUSICAL FUTURE

Gifts to Endowment ensure our artistic and financial success for future years. These gifts are placed in a restricted account and professionally managed and invested. Money invested in an endowment (the “Principal”) is not spent. Only the income generated by the investment is available for use. Your gift remains in the fund and continues to earn income for LJS&C for years to come. Our Endowment, when fully funded, is expected to produce income of up to $75,000 per year in support of our Artistic Director salaries. When making a gift to this fund, please specify that your gift is for Endowment.